Opening a food truck, walking food

Verified 01 January 2026 - Entreprendre Public Service / Directorate of Legal and Administrative Information (Prime Minister)

Embarking on the street food, open a food truck represents an interesting solution in particular for starting an activity. We explain step by step the steps to be carried out.

Project Preparation

What is the nature of the activity?

The profession of restaurateur can be a commercial or craft activity.

Generally, food trucks are run by a cook who makes the dishes himself from fresh products, called “homemade”. He then carries out a craft activity.

In addition, the majority of food trucks do not employ more than 11 employees. Below this threshold, the company must be registered in the National Register of companies (RNE) as a company in the trades and crafts sector.

On the other hand, if a food truck employs more than 11 employees, registration with the Trade and Companies Register (RCS) is mandatory.

The majority of food truck companies are artisanal. For more information, you can consult our sheet which specifies the conditions to be met to have the status of craftsman.

What skills are useful to manage a company?

It is important to think ahead to the skills that will be useful to manage a company.

The company creator may be confronted in particular with difficult situations.

If its activity expandsHowever, it will also be required to hire and supervise staff.

Testing and training exist to target skills useful for company creation.

There are, for example, following tests :

Entrepreneurial test "Character traits"

Entrepreneurial test "Determination and motivation"

Entrepreneurial test "Resources and skills"

These tests accompany the reflection of the project leader.

They are not definitive answers without alternatives. It is always possible toacquire new skills.

Please note

It is advisable, as far as possible, toanticipating difficulties. If the project leader has the possibility to constitute a financial reserveHowever, this can allow him to cope with an unexpected event. It is also prudent to anticipate a steady pace of work, at least when starting the activity: weekend and evening, overtime.

Accompaniment of the project leader

In order not to remain alone with your project, the following steps can be beneficial:

- Meet other contractors of the same sector of activity

- Getting to fairs and exhibitions in connection with the future activity

- To be accompanied by the consular networks : advisers to CMA: titleContent in the case of a craft activity, in particular via the CMA Freedom Passaccompanying formalities ; advisers of CCI: titleContent of his department in the case of a commercial activity.

- To be accompanied by associative networks :

Financial aid

If the project leader does not have enough own funds to launch your company, there are external financial solutions.

It is possible to consult our page dedicated to the search for funding to create or take over a company. The crowdfunding or crowdfunding is also an interesting option.

When the project leader starts his activity, he can opt for aid schemes such as:

- The contract to support the company project (Cape) which relieves the creator of certain administrative formalities and guarantees the professional

- THEaid for the creation or resumption of a company (Acre) which consists of a temporary exemption from social security contributions at the beginning of activity

- Or theArce (Support for business recovery or creation) which allows the jobseeker who wishes to set up or take over a company to receive part of his unemployment benefits as capital.

The following website lists all the public aid existing:

Entrepreneurship training

It is important to prepare for your future status as a restaurant entrepreneur.

The trainings The following help to better understand it:

- Perform a immersion course in the catering sector

- Consult the website of France Travail which lists all the escorts to creation

- Get closer to the Chamber of Trades and Crafts (CMA) of his region. It proposes support for the creation of a company.

- If the project leader is a job seeker, France Labor (formerly Pôle emploi) offers company creation preparation training

- Learn management and accounting.

These courses are optional, but highly recommended.

The choice of a legal form (or legal status) of the company is a decisive step.

It determines how the company operates, but it also has implications for the tax system and social protection.

There are two main legal forms:

- ₪(EI) : allows the holder to carry out his activity alone and in his own name. The Head of company and the one and the same person. Micro-company (or self-company) is one with a simplified tax and social regime.

- Business : allows to carry out an activity in a legal entity distinct from the Head of company. It has the legal personality, i.e. it has its own legal existence (share capital, company name, registered office, etc.).

These two modes of exercise each have their own specific rules:

Répondez aux questions successives et les réponses s’afficheront automatiquement

- (including micro-entrepreneur)

The creation of an entity (EI) involves few formalities (no drafting of statutes, no constitution of share capital and partner, etc.) and allows to launch its activity quickly. The assets of the individual entrepreneur (IC), including the micro-entrepreneur, are automatically separated into professional and personal assets.

FYI

For more information, please refer to the fact sheet on the separation of professional and personal assets.

Tax and social system of the classical

The individual entrepreneur is subject to income tax (IR), in the category corresponding to his activity (BIC: titleContent, NCB: titleContent , BA: titleContent..).

However, it is possible to opt for the actual tax regime or even for thebusiness tax (IS).

The individual entrepreneur is covered by the Social Security scheme for self-employed persons. He has the status of a self-employed person (TNS). It does not pay social contributions during at least 90 days which follow the start of its activity.

For more information, our fact sheet on the social protection for traders and craftsmen details the contributions due and the arrangements for reporting and payment.

FYI

Our fact sheet on the₪(EI) specifies all operating rules.

Simplified micro-company regime

The scheme of micro-entrepreneur is a very simplified social and tax system. It is applicable when the turnover HT: titleContent does not exceed certain thresholds: for example €188,700 in the case of an activity of selling goods, or €77,700 for the provision of services

The simplified scheme applies automatically for the year of establishment (N) and the following year (N+1) provided that these thresholds are met.

Furthermore, the micro-company is subjected to the exemption from VAT : i.e. the entrepreneur does not declare VAT on the services or sales he makes and cannot deduct it either.

As regards the taxation of income, micro-company is imposed on theIR: titleContent, in the category corresponding to its activity: micro BIC: titleContent, microphone NCB: titleContent , microphone BA: titleContent..). The tax due is calculated taking into account a flat-rate abatement on turnover for business expenses which varies according to the activity carried out (for an activity of selling goods: the allowance corresponds for example to 71% turnover).

For more details on tax allowances, you can consult the sheet on the tax regime for micro-entrepreneurs.

Finally, the entrepreneur pays social security contributions only if he generates turnover.

Warning

Revenue generated from 1er January 2026 (and reported in 2027) is submitted, for the application of the micro-entrepreneur (micro-fiscal) tax system, to new thresholds, of which the amount will be set by the finance law for 2026. This law must be passed in the coming weeks.

In the meantime, the budgetary provisions planned for 2025 have been renewed by a special law no. 2025-1316 of 26 december 2025.

Business

The business is a legal entity that has a legal personality, i.e. it has its own legal existence (share capital, company name, registered office, etc.). It can sign a commercial lease, hire employees and has a separate estate from that of its partners. It is represented by an officer (a manager or a president) who carries out the activity.

The interest of create a business is to limit the liability of the professional and his associates to the contributions made when the business was set up. It thus makes it possible to protect the personal heritage of each individual.

The trader may engage in a commercial and/or craft activity alone (creating a EURL or a SASU) or byassociating with other persons (SARL, SAS, SAetc.). The creation of a business requires the completion of various formalities such as the drafting of statutes, the deposit of a share capital which can be costly. In addition, the business must comply with various accounting obligations (keeping and filing of annual accounts, convening of shareholders at general meetings (AGMs), holding AGMs for any modification of the statutes of the business, etc.).

Tax system

The profits made by the business are in principle subject tobusiness tax (IS). For certain types of businesses, partners can opt for income tax (IR). In this case, the benefits are reported as BIC: titleContent in the income tax return.

Social protection

The social protection of the business manager varies according to the type of business chosen. The manager of a EURL or a SARL (if he is a majority) is considered a self-employed person and must contribute to the Urssaf on income from self-employment or on a minimum annual basis.

The manager of a SAS, SASU, SARL (minority or egalitarian) is considered as a salaried assimilated worker. It is part of the general social security system. He has a social protection very close to that of an employee. If he does not pay himself wages, he does not have to pay social security contributions.

To make the right choice, it is therefore essential to take into account many factors:

- Exercise of the activity alone or with several partners (in business )

- Tax regime for the taxation of profits

- Social protection scheme according to the envisaged legal form.

To help you choose the legal form that best suits your situation, Urssaf offers the following simulator:

Find the right legal status (form) and compare the cost of social contributions

Status of the Individual Contractor (IC)

Micro-company regime

Companies affected by SI

Strategic choice: adapt its catering offer

The success of a food truck often depends on its location.

It may be useful to carry out a customer analysis in the territory envisaged.

The commercial offer of the food truck must correspond to the needs and to behaviors the future target clientele.

It is therefore important to adapt the type of catering to your clientele or to change location.

There are many possibilities; there are for example rotisserie trucks, pizzeria trucks, creperie trucks, food trucks of Asian cuisine, others offer only burgers, etc.

Example :

A food truck settled in front of a cinema in an urban area will not necessarily offer the same commercial catering offer as in front of a sports stadium in a rural environment.

Analysis of the territory

The area in which the project is located must be analyzed in advance (economic, social, cultural, etc.).

THEDirectory of companies can be used as an advanced search tool (free of charge) to list companies in a territory and in a field of activity.

Company Directory: Find all the information in a company

FYI

Only one market research complete to define the needs of a clientele envisaged. For more information, you can consult the page dedicated to How to carry out a market study?

The big options

Several types of pitches to settle a food truck are possible:

- One fixed place on fixed days and hours

- Multiple locations : for example, a place for the noon and another the evening

- Some markets, halls

- In front of cultural or sporting events such as concert halls, cinemas, stadiums, etc.

It is possible to mix the different possibilities. However, it is important to retain a clientele by offering fixed appointments.

Please note

Each of these options requires a authorization (AOT) to settle a food truck in thepublic space. The professional must also obtain a merchant/craftsman card (see details below under “Formalities” and “Operation”).

Truck or trailer?

It is possible to use either a truck or a vehicle with a trailer.

The truck has the advantage of being ready to use as soon as the driver stops the engine. The trailer, on the other hand, requires an installation at each place where he wishes to work.

The professional must indeed know uncoupling the coupling and attach trailer on the ground in a balanced way. This makes the installation longer for a truck. The trailer is also more difficult to drive.

If the truck falls into failureHowever, all the activity is blocked, whereas with a trailer the professional is less dependent on breakdowns.

The advantage of a trailer is not to lose value and to be able to resold easier than a truck.

It is also simpler to change offer catering with a trailer, if the professional so wishes.

Please note

In the case of a trailer, it shall be registered if its PTAC exceeds 500 kg ; which is very often the case given the weight of the equipment.

How much does it cost?

A new truck will cost between €30,000 and €100,000 depending on the type of restoration and the facilities.

Example :

A rotisserie truck will cost more with its rotisserie than a burger truck with a plancha and a deep fryer, and even more than a pancake truck with its crepe makers. The pizza truck will also be more expensive because of its oven and its high safety standards.

A new trailer will cost between €10,000 and €20,000, depending on the equipment.

New or used?

The new purchase is of course more expensive, especially for a truck.

Even if most professionals are serious, it is more prudent to check the certificates of compliance with health and safety rules.

Warning

In the case of a used vehicle purchase, it will be necessary to check that the equipment of the truck is up to safety and hygiene standards. For this, the buyer must recover all the certificates. The controls are common and the activity can be stopped for non-compliance.

Rent a truck?

Renting a truck can be a wise choice for test its activity. The consequences in case of failure will be less serious than if the professional goes into debt for the purchase of a truck.

This makes it possible to refine your idea and possibly change it, for example depending on the type of restoration proposed.

Verification of gas and electricity equipment and installations

New or used, the truck or trailer and their equipment must meet standards stringent of safety and hygiene.

The equipment must have a water point.

In case of cooking, there must be a hood of evacuation.

The restaurateur must have the certificates of conformity of all equipment. these must be properly fixed, watertight and washable.

Insurance of the vehicle

Like all motor vehicles, the owner of the vehicle has thelegal obligation to insure the truck (against theft, accidents, etc.).

It is important to clarify to the insurer that it is a working tool. Truck insurance can be taken out at the same time as insurance for the activity (professional property and casualty insurance and professional liability).

Please note

This insurance for the activity is mandatory to make a application for a traveling business card, which is itself necessary to exercise. It is also required when applying for a temporary occupation permit (public space) AOT.

Driving license

The total permissible laden weight (PTAC) of the vehicle determines the type of driving license that the professional must possess.

The PTAC is included in the F2 entry of the ₪ of the vehicle.

In the case of a trailer, it is necessary to look at both the PTAC of the trailer and the Total PTAC, i.e. the addition of the PTAC of the towing vehicle + the PTAC of the trailer.

The type of driver's license is different depending on the weight of the truck or towed coupling with trailer.

Répondez aux questions successives et les réponses s’afficheront automatiquement

Truck less than 3.5 t of PTAC

If the food truck has a PTAC: titleContent less than or equal to 3.5 tons permit B enough.

Truck over 3.5t PTAC

If the food truck has a PTAC: titleContent greater than 3.5 tons, the driver must possess the truck license. This is one of the C permits, in particular the C1 permit.

Trailer and towing vehicle

Food-truck trailers very often weigh more than 750 kg. The following information corresponds to this criterion.

Trailer + towing vehicle less than 4.25 t

If the coupling meets the following 2 criteria:

- PTAC: titleContent of the trailer greater than 750 kg,

- and maximum permissible mass of the assembly, car + trailer, greater than 3 500 kg but less than 4 250 kg,

then the driver must possess the permit B and take an internship d'1 day driving school.

The driver's license will then be marked B96, without examination.

Trailer + towing vehicle over 4.25 t

If the coupling meets the following 2 criteria:

- PTAC: titleContent of the trailer greater than 750 kg,

- and maximum permissible mass of the assembly, car + trailer, greater than 4 250 kg,

₪mention VASP-Magasin

The food-truck truck or trailer must receive theapproval VASP: titleContent : specially equipped motor vehicle, with the words ‘Shop’.

Without this, the driver will not be given permission to drive when he passes the roadworthiness test.

This approval guarantees that the truck or trailer complies with the safety standards corresponding to the professional activity.

The restaurateur must ask this VASP approval with the Drealfrom its region:

Formalities of creation

The choice of a legal form (or legal status) of the company is a decisive step.

It determines how the company operates, but it also has implications for the tax system and social protection.

There are two main legal forms:

- ₪(EI) : allows the holder to carry out his activity alone and in his own name. The Head of company and the one and the same person. Micro-company (or self-company) is one with a simplified tax and social regime.

- Business : allows to carry out an activity in a legal entity distinct from the Head of company. It has the legal personality, i.e. it has its own legal existence (share capital, company name, registered office, etc.).

These two modes of exercise each have their own specific rules:

Répondez aux questions successives et les réponses s’afficheront automatiquement

- (including micro-entrepreneur)

The creation of an entity (EI) involves few formalities (no drafting of statutes, no constitution of share capital and partner, etc.) and allows to launch its activity quickly. The assets of the individual entrepreneur (IC), including the micro-entrepreneur, are automatically separated into professional and personal assets.

FYI

For more information, please refer to the fact sheet on the separation of professional and personal assets.

Tax and social system of the classical

The individual entrepreneur is subject to income tax (IR), in the category corresponding to his activity (BIC: titleContent, NCB: titleContent , BA: titleContent..).

However, it is possible to opt for the actual tax regime or even for thebusiness tax (IS).

The individual entrepreneur is covered by the Social Security scheme for self-employed persons. He has the status of a self-employed person (TNS). It does not pay social contributions during at least 90 days which follow the start of its activity.

For more information, our fact sheet on the social protection for traders and craftsmen details the contributions due and the arrangements for reporting and payment.

FYI

Our fact sheet on the₪(EI) specifies all operating rules.

Simplified micro-company regime

The scheme of micro-entrepreneur is a very simplified social and tax system. It is applicable when the turnover HT: titleContent does not exceed certain thresholds: for example €188,700 in the case of an activity of selling goods, or €77,700 for the provision of services

The simplified scheme applies automatically for the year of establishment (N) and the following year (N+1) provided that these thresholds are met.

Furthermore, the micro-company is subjected to the exemption from VAT : i.e. the entrepreneur does not declare VAT on the services or sales he makes and cannot deduct it either.

As regards the taxation of income, micro-company is imposed on theIR: titleContent, in the category corresponding to its activity: micro BIC: titleContent, microphone NCB: titleContent , microphone BA: titleContent..). The tax due is calculated taking into account a flat-rate abatement on turnover for business expenses which varies according to the activity carried out (for an activity of selling goods: the allowance corresponds for example to 71% turnover).

For more details on tax allowances, you can consult the sheet on the tax regime for micro-entrepreneurs.

Finally, the entrepreneur pays social security contributions only if he generates turnover.

Warning

Revenue generated from 1er January 2026 (and reported in 2027) is submitted, for the application of the micro-entrepreneur (micro-fiscal) tax system, to new thresholds, of which the amount will be set by the finance law for 2026. This law must be passed in the coming weeks.

In the meantime, the budgetary provisions planned for 2025 have been renewed by a special law no. 2025-1316 of 26 december 2025.

Business

The business is a legal entity that has a legal personality, i.e. it has its own legal existence (share capital, company name, registered office, etc.). It can sign a commercial lease, hire employees and has a separate estate from that of its partners. It is represented by an officer (a manager or a president) who carries out the activity.

The interest of create a business is to limit the liability of the professional and his associates to the contributions made when the business was set up. It thus makes it possible to protect the personal heritage of each individual.

The trader may engage in a commercial and/or craft activity alone (creating a EURL or a SASU) or byassociating with other persons (SARL, SAS, SAetc.). The creation of a business requires the completion of various formalities such as the drafting of statutes, the deposit of a share capital which can be costly. In addition, the business must comply with various accounting obligations (keeping and filing of annual accounts, convening of shareholders at general meetings (AGMs), holding AGMs for any modification of the statutes of the business, etc.).

Tax system

The profits made by the business are in principle subject tobusiness tax (IS). For certain types of businesses, partners can opt for income tax (IR). In this case, the benefits are reported as BIC: titleContent in the income tax return.

Social protection

The social protection of the business manager varies according to the type of business chosen. The manager of a EURL or a SARL (if he is a majority) is considered a self-employed person and must contribute to the Urssaf on income from self-employment or on a minimum annual basis.

The manager of a SAS, SASU, SARL (minority or egalitarian) is considered as a salaried assimilated worker. It is part of the general social security system. He has a social protection very close to that of an employee. If he does not pay himself wages, he does not have to pay social security contributions.

To make the right choice, it is therefore essential to take into account many factors:

- Exercise of the activity alone or with several partners (in business )

- Tax regime for the taxation of profits

- Social protection scheme according to the envisaged legal form.

To help you choose the legal form that best suits your situation, Urssaf offers the following simulator:

Find the right legal status (form) and compare the cost of social contributions

Status of the Individual Contractor (IC)

Micro-company regime

Companies affected by SI

Before making the registration the professional must have chosen a trade name or a denomination for his company. The choice differs for a {circumflex over (x)} or a business.

Répondez aux questions successives et les réponses s’afficheront automatiquement

Individual contractor (including micro-company)

If the restaurateur chooses to practice as an individual contractor (EI) the name of his company will be the same as his proper name (or last name).

Indeed, in the case of an EI (legal form that also includes micro-company), the professional is responsible as a natural person of his company, he exercises in his proper name. The name of its company corresponds to its proper name.

The trader can also choose a trade name in parallel. Unlike the name, it is optional. It can be used to better identify the activity of the company, particularly in its communication activities.

For more details, it is possible to consult our page on denomination of a (EI).

Please note

On all company documents, the word “EI” must appear after the name.

Individual Contractor (IC) Name

Business

If the restaurateur has chosen to practice under the legal form of the business, the corporate name of his company is free.

The name often reflects the activity carried out. He must write the chosen name in the statutes of the company.

For more details, it is possible to consult our page dedicated to name of a business.

Declaration and registration of a business

Limited liability company (SARL): company name (L223-1)

Declare the activity on the company formalities window

Legal existence of the company and identification numbers

The trader must register the company.

This procedure must be carried out online on the website of the companies' Formalities Window:

The trader must apply for registration within one month of the declared start date of the activity and no later than 15 days after the start date of the activity. The effect of this formality is to give the company legal status.

This declaration makes it possible to inform all the organizations concerned by the launch of the activity (INSEE, social organizations, Urssaf, public finance center, etc.).

As soon as the application for registration is accepted, INSEE allocates:

- A number Siren : it is a unique identification number of the 9-digit company

- A number Siret : it's thegeographical identifier of each of the establishments from the company, it is therefore possible to have several. This number consists of the Siren and a NIC (Internal Ranking Number).

When registering the company, INSEE also assigns the professional its code EPA: titleContent.

Domiciliation of the company

During the registration procedure on the website of the company formalities desk, the address of the company must be provided.

It generally corresponds to the premises (shop, workshop, etc.) in which the activity is carried out.

If the trader owns both a fixed establishment and another itinerant, he can domicile the itinerant activity at the same address as the fixed premises, such as 2d establishment.

When the activity is only itinerant, the trader may choose to domiciliate his activity at his personal address or through a domiciliation business.

For more information, please refer to our page Domiciliate your {circumflex over (including the micro-company)}, or Domiciliate your business.

Please note

In case of itinerant activity, you must ask for a tradesman or street trader card from the CCI: titleContent or CMA: titleContent the location of the activity.

Declaration of the prospective spouse working in the company

When the spouse (married, partner of Civil partnerships: titleContent or cohabiting partner) of the head of company professional activity regular in the company, a sworn certificate must be provided, indicating its status. It is possible to opt for one of the following statutes: collaborating spouse, salaried spouse, associate spouse.

The choice of a status makes it possible to guarantee rights to the spouse, in particular rights to retirement.

When registering the company, the Head of company declares the status chosen by the spouse on the website of the company formalities desk by providing the following document:

For more information on the status of the spouse, please refer to the fact sheet on the spouse of the head of company.

FYI

If no status has been declared, the spouse is considered to have opted for the status of salaried spouse.

Submit a declaration of non-conviction

When registering his activity on the company formalities window, the trader must provide a declaration on honor of non-conviction.

By this declaration, he attests that he has not been the subject of any criminal, civil or administrative sanction prohibiting him from setting up and managing a company.

One template declaration of non-conviction and parentage is available:

The professional must declare the existence of his restaurant and his activity to the town hall of the commune where thecompany is domiciled.

This declaration must be made 15 days minimum before opening from the restaurant.

FYI

For more details, it is possible to consult the page dedicated to domiciliation of a or to the domiciliation of a business.

This declaration is made in filling out the form next:

Declaration of a restaurant or a bar for drinks to be consumed on site or to be taken away

What is the traveling merchant card?

The professional restaurateur who operates a food truck must possess the traveling business card.

This card allows him to move outside of the municipality of its professional domiciliation.

Every trader is concerned by this obligation whether or not he has a fixed commercial premises and regardless of his status.

If the company hires one or more employees, they must have a copy of the executive's traveling business card when they are practicing on the go.

The card is valid 4 years.

It costs €30.

How do I get the traveling business card?

To obtain the card, the professional must perform a prior declaration for theexercise of a traveling activity.

It must approach either the chamber of commerce and industry (CCI) or the Chamber of Trades and Crafts (CMA) of its place of attachment.

This is the Chamber (CCI or CMA) competent for the municipality of the declarant's domicile, business address or the registered office of the business.

The CCI processes applications from professionals registered in the RCS: titleContent. The CMA handles requests from professionals that are registered exclusively in the RNE: titleContent, or registered in the SCN and the RNE.

Many CMAs and CCIs use the cerfa form no. 14022 next:

Prior declaration for the exercise of a traveling commercial or craft activity

Some CMAs and CCIs offer a form specific to their region.

FYI

Some KICs propose a fully-fledged approach dematerialized to apply for a traveling merchant card. This is the case, for example, with the CCI Bretagne. It is then indicated upstream of the formality, the technical conditions necessary for the smooth running of the process (electronic signature, digitized photographic retouching, format of the identity document, etc.). One detailed instructions for use are available online.

The form must be completed, scanned and then forwarded to the CCI or CMA (either by registered mail with acknowledgement of receipt, or on site, or by email depending on the region).

The cost of the card is €30.

The documents to be provided are listed below and are often also mentioned on the page dedicated to this approach on the CMA or CCI website.

When applying for a merchant or craftsman card, the professional must provide supporting documents, in addition to form 14022.

The documents are different depending on the country of establishment, in France or in a country of the European Union (EU):

France

- Proof of declaration of activity less than 3 months old:

- If the registrant is registered in the Trade and businesses Register (RCS): an extract K or Kbis less than 3 months old

- If the registrant is registered in the National Register of companies (RNE): a proof of registration less than 3 months old with the entries in this register

- Copy of the identity document valid: copy of passport or national identity card, or double-sided copy of residence permit

- For the persons accommodated : in the case of accommodation with an individual, an original accommodation certificate signed by the host and a copy of proof of residence of the host - in the case of accommodation in a social center, a copy of the certificate of domicile of the social organization such as the Center d'Action Sociale (CCAS) or the Center Intercommunal d'Action Sociale (CIAS), to which the municipality of attachment depends

- 2 recent identity photographs in 35 x 45 mm format

- Check from €30 made payable to the ICC or CMA.

State of the European Union

- Proof of declaration of activity: for natural and legal persons who do not have an establishment in France but who have declared their commercial or craft activity in another State of the European Union, the document must be translated into French and mention the activity (it must allow a non-sedentary commercial activity)

- Copy of the identity document valid: copy of passport or national identity card, or double-sided copy of residence permit

- Copy of a proof of address recent on behalf of the company's legal representative (e.g. last rent receipt or last gas or electricity bill, voter registration, tax receipts, tax warning, telephone bill)

- For the persons accommodated : in the case of accommodation with an individual, an original accommodation certificate signed by the host and a copy of proof of residence of the host - in the case of accommodation in a social center, a copy of the certificate of domicile of the social organization such as the Center d'Action Sociale (CCAS) or the Center Intercommunal d'Action Sociale (CIAS), to which the municipality of attachment depends

- 1 recent photograph in 35 x 45 mm format

- Check from €30 made payable to the ICC or CMA.

If the file is complete, the professional receives a card in the 15 days approximately after the form and supporting documents have been sent, and within a maximum of one month.

He can ask for a provisional certificate valid for one month if it is to start its activity.

The card is valid 4 years, after which it must be renewed at the initiative of the trader.

In case of control, thelack of declaration prior to obtaining the card, generates a fine from €750. If the professional has forgotten to take his card with him during his business trips or if he has forgotten to carry out his renewal, the fine is €450.

Who shall I contact

How to renew the traveling business card?

The map is valid for 4 years.

If the professional wishes to renew his card, he must make the request.

This request can be made from1 month before the expiration date of validity and up to 2 months after this date. If this time limit is exceeded, an initial application must be resubmitted.

The renewal request is made by filling out the Cerfa form n° 14022, which is downloadable on the website of the CCI or the CMA of the professional's affiliation.

This is the Chamber (CCI or CMA) competent for the municipality of the declarant's domicile, business address or the registered office of the business.

The CCI processes applications from professionals registered in the RCS: titleContent. The CMA handles requests from professionals that are registered exclusively in the RNE: titleContent, or registered in the SCN and the RNE.

This form must be completed and sent either by registered post with acknowledgement of receipt or by email in certain regions.

Prior declaration for the exercise of a traveling commercial or craft activity

Please note

Some KICs propose a fully-fledged approach dematerialized to apply for a traveling merchant card. This is the case, for example, with the CCI Bretagne. It is then indicated upstream of the formality, the technical conditions necessary for the smooth running of the process (electronic signature, digitized photographic retouching, format of the identity document, etc.).

The time to receive the new card is between 15 days and one month.

It is possible to request a provisional certificate during the waiting period. It is valid for 1 month maximum. For this, the professional must return theold map.

Warning

To make location requests, the professional must have the following 2 elements:

- Unique identification number (Siren), which implies having already registered your company

- Professional insurance for its activity.

Location on a sidewalk or public square

The restaurateur must request a parking permit.

This permit is intended for trade whose occupation of public space is right-of-way fixed to the ground.

How to apply for a parking permit?

The file varies according to the municipalities.

It consists of a declaration form and documents to be provided. These are:

- or a form specific to the municipality. It can either be downloaded from the website of the town hall where the activity takes place (or the prefecture if the request concerns a major artery of the city), or available on site in the town hall or prefecture (if it is a major artery of the city, a departmental or national road).

- or form cerfa n° 14023.

The documents to be attached to the form are as follows:

- Copy of the extract K or Kbis or proof of registration at RNE: titleContent

- For cafés, bars and restaurants: copy of the license on behalf of the owner or operator of the business

- Copy of commercial lease or title deed

- Certificate of insurance for the occupation of public space

- Description of the terrace or display and the materials used, with a plan specifying the location of the device on the sidewalk and its area

- Map of walking trade

- Map of MSA: titleContent for agricultural producers

- Bank Identity Statement (RIB).

Please note

The list of documents to be provided may vary from one municipality to another.

The file must be sent either to the town hall or to the prefecture if it is a major urban artery, a departmental or national road.

To know everything about parking permit applications, it is possible to consult our page dedicated to the occupation of the public domain by a business (AOT).

Location in a market

If the food truck wishes to set up in one or more markets in its territory, it can choose either to request a fixed location or a flying place.

Répondez aux questions successives et les réponses s’afficheront automatiquement

Fixed place

If the professional wants to get a fixed location on a market covered or overdrawn, he must apply to the town hall concerned.

If he gets it, he will have to pay a place fee through a subscription (annual, quarterly or monthly).

For the sake of equality before public services, it is forbidden to reserve pitches for traders resident in the municipality.

Occasional flying place

If the professional wants a vacant location by the day (said steering wheel seat or passenger seat), he must make the request to the receiver-placier.

He payroll then one royalty per busy day.

According to the conditions detailed in the municipal regulation, the allocation of vacant space can be made by drawing lots or by order of arrival, after registration on a waiting list.

For the sake of equality before public services, it is forbidden to reserve pitches for traders resident in the municipality.

FYI

For more details, you can consult the following page: How to request a location in a market or market hall?.

Location in a festival, fair, event

The location request must be made to the event organizer.

It is also possible to inquire at the town hall concerned.

If he gets the location, the professional must pay a royalty to the organizer.

The professional is not legally obliged to take out insurance for its activity of restaurateur.

Warning

However, having insurance is necessary to obtain a traveling merchant card (mandatory for a food truck manager), as well as for any request forAOT: titleContent.

This is a professional property and casualty insurance. It may include professional civil liability (CPR).

The professional must ask his usual insurer.

She protects the restaurant owner, his goods, his customers and possibly his employees (in the case of a CPR).

Protection concerns accidents:

- Hardware (inventory of goods, IT, etc.),

- Intangible assets (operating loss),

- Bodily injury (accident, death).

For more details, it is possible to consult our pages dedicated to insurance professionals, depending on the company (individual, microphone or business) .

Rules of operation

Who is concerned?

Training in food hygiene rules is mandatory in commercial catering establishments, including food trucks and vans.

Most of diplomas in the cooking and catering sector automatically includes this training.

All it takes isonly one of the persons the institution or company has completed the training. This training is optional for a professional who can justify at least 3 years of activity in the food sector as manager or operator.

Warning

This training should not be confused with training HACCP: titleContent which, for its part, falls under the European regulation known as the “Hygiene Package”.

How does the training take place?

The training lasts 2 p.m. minimum.

Its cost varies between €200 and €500 (based on market prices).

There is no end date for the validity of this training and no obligation to renew it.

Where to find a training organization?

It is issued by a body approved by the Ministry of Agriculture.

The list of training organizations registered in a region can be consulted on the website of the Regional Directorate for Food, Agriculture and Forestry:

The list of organizations providing this training in the regions is also available on the site of agricultural education professionals: chlorofil.fr.

Food handlers must be supervised and must have food hygiene instructions and/or training appropriate to their professional activity.

This training is often called HACCP training. It is aimed at the entire agri-food sector.

This obligation is established by the European regulation governing food hygiene called “Hygiene Package”.

The name HACCP means in English Hazard Analysis Critical Control Point. It is a method of preventing and identifying hazards associated with food hygiene practices.

Any person handler of foodstuffs must have completed this training.

HACCP training can be provided either by a training organization or by the institution itself.

It is not subject to any content or duration requirements.

FYI

A company can organize itself the training on good hygiene practices of its employees (via the dissemination of instructions, exchanges of practices...). The use of an external service provider is not mandatory.

France Travail (formerly Pôle emploi) can help to find a provider performing this training:

Where to find my HACCP food hygiene training

Establishment of procedures based on HACCP principles

For any manipulating activity of food of animal origin intended for final consumers, the professional must make a declaration .

It has to be done before opening of the establishment. It must be addressed to the departmental directorate in charge of population protection (DDPP).

This declaration allows the Health and Food Safety Department of the DDPP to schedule health control visits.

Declaration of handling of food of animal origin

For more details, it is possible to consult our page on hygiene rules in catering and food shops.

Obligation to declare, approve and carry out health checks

The sale of spirits of more than 18 degrees is forbidden, regardless of the time and place of opening of the food truck. These are strong alcohols: rum, vodka, whisky, etc.

On the other hand it is possible to sell drinks whose alcohol title is lower à 18 degrees. These are mainly wine, beer and cider.

The obligations are not the same according to thetime to which those beverages are sold.

Alcohol sale before 10 p.m.

If the food truck sells alcohol with a titer of less than 18 degrees before 10 p.m. prior declaration enough.

The declaration must be sent at least 15 days before opening of the establishment.

The declaration must be forwarded to the town hall the place where the company is domiciled, or prefecture if it is located in Paris or in Alsace-Moselle.

Declaration of a restaurant or a bar for drinks to be consumed on site or to be taken away

Declaration for the sale of alcohol until 10pm: L3332-4-1

Sale of alcohol between 10pm and 8am

To sell alcoholic beverages qualifying for less than 18 degrees between 10pm and 8am, the professional must obtain a license called small take-away license.

For this, he must take training in a center of accredited training.

The training lasts about 8 p.m. (2.5 days).

If the professional is fully trained, he or she will receive a operating license, or license to sell alcoholic beverages at night: this is the PVBAN: titleContent.

This permit is valid 10 years.

It is renewable by performing a new 6-hour training.

Please note

For more than details on the sale of alcohol, you can consult the page entitled Restaurant licenses and beverage outlets.

Training for sale alcohol to take away after 10pm

The display rules are numerous.

The main ones concern drinks, alcohol, protection of minors, prices of products and their origin.

Display regarding beverages

If it is concerned, the merchant must display its small license of operation (sale of alcohol to take away at night).

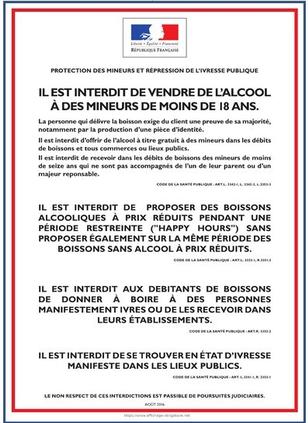

Ouvrir l’image dans une nouvelle fenêtre

It is a wall poster of A4 format (21 x 29.7 cm), on a white background. In the center at the top is inscribed the logo of the Marianne, blue, white, red.

It is written below several excerpts of articles of law, from the Public Health Code, concerning the repression of public intoxication and the protection of minors with respect to the sale of alcohol.

In particular: "It is forbidden to sell alcohol to minors under 18 years of age."

The following words are then added: "It is forbidden to be intoxicated in public places".

"It shall be prohibited for the operator of a drinking establishment to give or receive drinking to persons who are manifestly intoxicated".

The display of the regulations on the suppression of public intoxication and the protection of minors (prohibition of sale of alcohol to under 18 years) is mandatory.

It is forbidden to sell or offer free alcohol to a minor (person under 18 years of age).

If the trader does so, he risks a fine of €7,500 and a ban on operating its license for 1 year.

FYI

It is mandatory to submit a display of soft drinks for sale. At least 10 different drinks without alcohol must be visible by customers.

For more details, it is possible to consult our page on display requirements in a restaurant .

Meat Display

For meat, the trader must indicate the countries d'origin from all meats (poultry, beef, pork, sheep) on the menu or on display, for any type of meat dish or meat preparation.

This indication of origin shall be made by one of the following entries:

- Either Origin: (name of country) where the birth, rearing and slaughter took place in the same country.

- Either Born and bred : (name of country(ies)) and Shot (name of country) where birth, rearing and slaughter took place in different countries.

This obligation does not apply to purchased meat already cooked for resale.

In the event of non-compliance with these displays, the trader risks a fine of €1,500 for a natural person or €7,500 for a legal person.

Please note

For more details, it is possible to consult our page on display requirements in a restaurant .

To have the right to wear the mention HomemadeHowever, the dishes must be made from raw products (raw food), fresh, without assembly except with salt.

Dishes must be prepared on site.

The exception is for street catering, which can benefit from the mention even if the dishes were prepared in another establishment before being sold in the food truck.

For more details on the statement “ Homemade ”, it is possible to consult our page: Terms of use of the “Homemade” logo in catering.

Condition to be a artisan cook (“homemade”)

List of products and professionals concerned by the mention "homemade"

Contributions called by theUrssaf: titleContent depend on the structure of the business and the legal status of the manager.

To know all the rules concerning the social system of the manager, it is possible to consult the sheet relating to the Social protection of the business manager.

The trader who carries out his activity in his own name ({circumflex over (X)}) or as majority manager of a business (such as a EURL or a SARL), is affiliated to the Social security for self-employed persons (SSI), the compulsory scheme for self-employed persons.

The professional must pay social contributions to the Urssaf from the beginning of his activity.

However, in practice, no contributions or social contributions are required during the first 90 days which follow the launch of its activity.

Since the income is not yet known at the start of the activity, the contributions are first calculated on a flat-rate basis for the first 2 years (at the same rates as those applicable during the course of business). They are then adjusted and regularized according to the actual revenues of the fiscal year.

Contributions must be paid online in one of the following ways:

- Either every month : payment is made on the 5th or 20th of each month, by direct debit.

- Either every quarter : payment is made by direct debit, telepayment or credit card on 5 February, 5 May, 5 August and 5 November.

When he carries out his activity within the framework of a business and holds management functions that give him the status of employee assimilated (president or paid CEO of SAS for example), the professional reports to the general social security system.

His social security contributions are identical to those of an executive employee, and he enjoys equivalent social protection, with the exception of unemployment insurance (optional unemployment insurance is however possible).

Professionals covered by the social security scheme for self-employed persons

Basis for calculating contributions at the beginning of an activity (paragraph 2)

90 days for the first deadline

Payment schedule for social security contributions (III)

Monthly payments

Quarterly payments

Employee-related managers covered by the general scheme (11° and 12°)

The food truck company, like many companies (with a few exceptions), must pay a property tax, called the CFE (company property tax). To know the cases of exemptions, it is possible to consult page dedicated to the CFE.

In addition, if the food truck has one or more advertising signs in the public space, the operator must inquire about the possible payment of the local tax on outdoor advertising (TLPE). This tax depends on each municipality. The operator must contact the town hall of the location of its advertising sign.

Who can help me?

Find who can answer your questions in your region

- Chamber of Commerce and Industry (CCI)

- Chamber of Trades and Crafts (CMA)

- Town Hall

- Regional Directorate for the Environment, Planning and Housing (Dreal)

Associative networks

Network Undertake- BGE: support for entrepreneurs

- Initiative France Network

- France Active

- Adie: association for the right to economic initiative

Obligation of a traveling trader card and prior declaration of activity

Obligations of tradesmen and craftsmen whose terms of application for the traveling business card: R123-208-2; renewal: R123-208-4

Training for sale alcohol to take away after 10pm

Categories of driver's license

Compulsory food hygiene training

Trailer and towing vehicle training course PTAC less than 4.25 t

Online service

Search tools

Search tools

Online service

Online service

FAQ

Service Public

Service Public

Chambers of Crafts and Crafts (CMA)

Chambers of Crafts and Crafts (CMA)

France Labor

Chambers of Crafts and Crafts (CMA)

Ministry for the Environment